salt tax cap removal

D emocratic leadership outlined plans Monday to bypass GOP filibusters to alter the cap on deductions for state and local taxes paid a tax break largely. The relaxed cap an increase from the current 10000 limit would last for a decade until 2031.

Salt Deduction Cap Was Part Of A Package Wsj

At a news conference last month Pelosi called the limit devastating and said she wants to remove the cap which prevents taxpayers from deducting more than 10000 of state and local.

. By Joey Fox October 20 2021 252 pm. This tax will only be effective while the federal SALT. Repealing the SALT deduction cap is an expensive proposition.

The bill passed on a near. The rule which was put in place by former President Trump to help offset some of his tax cuts limits SALT deductions to 10000. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate.

164b6 added by the TCJA for tax years 2018 through 2025 limits the itemized deductions for personal property taxes state or local taxes foreign taxes and state and local sales. Lawmakers from high-tax Democratic-leaning states have. The House on Thursday voted to temporarily repeal much of the GOP tax laws cap on the state and local tax SALT deduction a key priority for many Democrats.

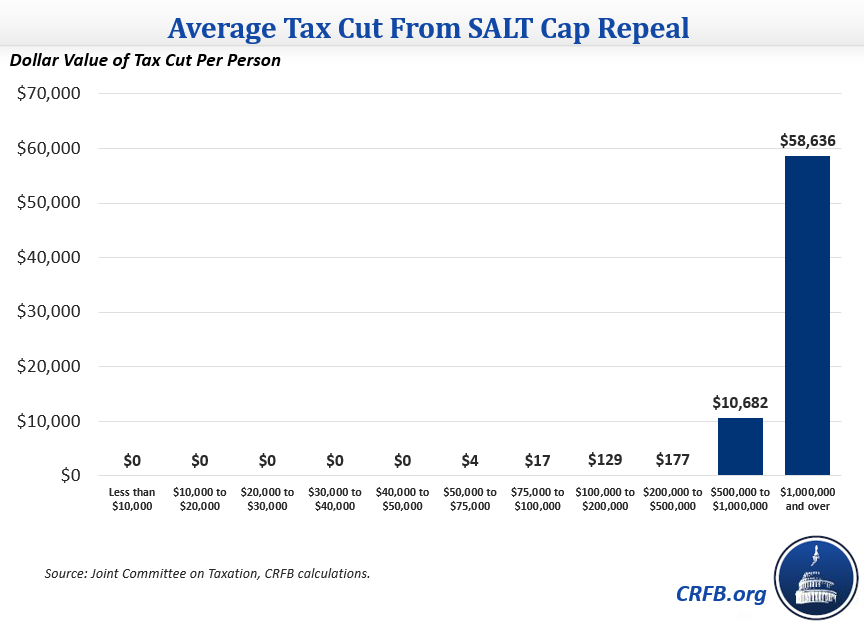

The existing 10000 limit on SALT is scheduled to expire at the end of 2025. Since the SALT cap was put into place however very high earners have seen a sharp reduction in the. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction according to new estimates by.

Democrats have Republicans to thank for clearing the way for the budgeting tricks that will allow them to do that. Josh Gottheimer Tom Malinowski and Mikie Sherrill were joined. The Supreme Court will not revive an attempt by New York and three other states to overturn the Trump-era 10000 cap on state and local tax deductions known as SALT.

Prior to enactment of the law known as the Tax Cuts and Jobs Act TCJA PL. Fully eliminating the cap for one year would cost 887 billion in 2021 according to the nonpartisan congressional tax. Individual owners of these electing PTEs may claim a tax credit equal to 100 of their distributive share of tax paid at the entity level.

Responding to reports from yesterday that the State and Local Tax SALT. Murphy pushing for SALT cap removal isnt willing to make an ultimatum. If you live in a state with high real estate taxes andor income taxes such as New York Connecticut or New Jersey the cap on the SALT deduction could mean youll pay more for tax years.

164 permits a federal deduction for taxes paid to state and local governments. The fight to remove the cap for state and local taxes SALT continues for three North Jersey members of the House. The SALT deal appeared to remove one obstacle to passing the sprawling 19 trillion spending.

The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income. August 9 2021 1133 AM 3 min read. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break for the wealthy.

54 rows The Internal Revenue Service IRS has provided data on state and local taxes paid and deducted for tax year 2018 the first year the SALT cap went into effect.

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

San Francisco 49ers Schedule News Photos Stats Players 49ers Football 49ers Players Cute Football Players

Cute Waterproof Shower Cap Shower Hat Bathroom Accessories Bathroom Set Z319 Ym Shower Bath Shower Cap Bathroom Sets

Why This Tax Provision Puts Democrats In A Tough Place Time

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Enhanced Recovery After Surgery And Anesthesia The Anesthesia Insider Blog Anesthesia Business Consultants Nutrition Infographic After Surgery Anesthesia

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

2 In 1 Stainless Steel Manual Salt Pepper Mill Grinder Seasoning Cooki Salt Pepper Mills Cooking Tools Stuffed Peppers

Dems Don T Repeal The Salt Cap Do This Instead Itep

Salt Deduction Relief May Be In Peril As Build Back Better Stalls

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

Purex Crystals Freshens Laundry And Carpet Win 2 Free Purex Crystals Purex Home Cleaning Remedies

This Bill Could Give You A 60 000 Tax Deduction

Pin By Bertha Phillips On Grandma Mary S Recipes Frosting Recipes Retro Recipes Vintage Recipes