city of loveland co sales tax return

Loveland council asks that proposed sales tax hike return as decision item Citys sales tax was last raised to 3 in 1984. The Loveland Sales Tax is collected by the merchant on all qualifying sales made within Loveland.

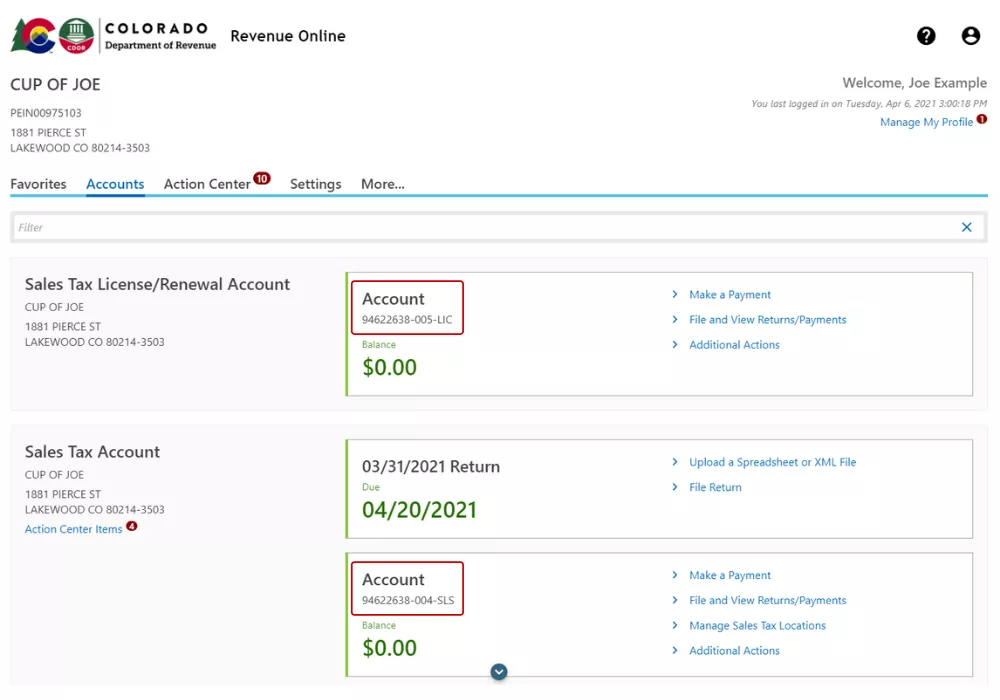

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

This rate includes any state county city and local sales taxes.

. Third Street Loveland. Sales aggregate to line 1 front of return periods net taxable sales aggregate to line 4 front of return a list of purchases if additional space needed-attach schedule in same format b total purchase price of property subject to city use tax enter totals here and on front of return enter total line b on line 11 on front of return. The Colorado sales tax rate is currently.

Verify a Colorado sales tax license Instructions below Check county and city sales tax rates Instructions below Verify the sales tax rates at a specific locations Obtain a rate chart for a specific tax percentage Find tax rates by address. Post Date04282022 1205 PM. City of Loveland - Sales Tax Administration is located at 410 E 5Th St in Loveland CO - Larimer County and is a business listed in the categories City County Government Miscellaneous Government Government Offices City Village Borough Township and Government Offices.

City of Sheridan 4101 S Federal Boulevard Sheridan CO 80110-5399 Phone. To view Building Permits click Public Access from the choices on the left no login credentials needed For Sales Tax please provide email login and password. All residents must file a return even if no tax is owed.

110 Loveland CO 80537 Phone. Schedule sales and use tax and fee audits. CITY OF LOVELAND SALES TAX RETURN INSTRUCTIONS.

The latest sales tax rate for Loveland CO. This is the total of state county and city sales tax rates. CITY OF LOVELAND COLORADO 500 E.

Welcome to Sales Tax. Therefore the PIF and RSF becomes a part of the overall cost of the sale and is subject to sales tax. Groceries are exempt from the Loveland and Colorado state sales.

500 East Third Street Ste. Before you apply for a sales tax license or submit your first payment please contact your bank and provide them with the City of Lovelands ACH DebitAccess ID 8846000609 to ensure your payment will not be rejected. The PIF and RSF are specifically fees and are NOT sales tax.

Researches taxpayers sales tax and fee returns and related data to justify selection of businesses to be audited. About City of Loveland. Three possible scenarios for.

DR 0594 - Renewal Application for Sales Tax License. Click on the link below to. 4 rows The 67 sales tax rate in Loveland consists of 29 Colorado state sales tax 08.

Jodi Lessman Assistant Public Works Director 9709622555. The Loveland sales tax rate is. Residents who work in areas imposing less than a 1 earnings tax must pay the difference to Loveland.

Register as a new User Apply for a Sales Tax License Renew your License or File your Return Citizen Access Login. DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet. 2020 rates included for use while preparing your income tax deduction.

Revised November 2019 Page 1. The RSF is 10 on all sales transactions that incur the City of Loveland sales tax auto sales are exempt from collecting the RSF. The County sales tax rate is.

DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. Primarily responsible for auditing business accounting records to assure compliance with the Citys Sales and Use Tax Ordinance. The City of Loveland income tax is a 1 earnings tax on persons who live or work in the City.

DR 0154 - Sales Tax Return for Occasional Sales. Lovelands Operation Spring Clean Sweep Launches May 2. DR 0235 - Request for Vending Machine Decals.

Line 1 Enter total receipts from all sales services rentals Line 4 Enter the difference between Line 2B and 3 leases both taxable non-taxable Line 2A Enter bad debts collected during the period which Line 5 Calculate the amount of Loveland sales tax were previously deducted on line 3D in prior periods due by. Centerra Fee District Businesses located in the Centerra Fee districts sales tax rate is 175 and is in addition to the district fees. File special event sales tax returns Instructions below Add Power of Attorney.

The City of Loveland on behalf of the Centerra Public Improvement Collection Corporation. A credit is given to residents who pay taxes to other municipalities. Researches taxpayers sales tax and fee returns and related data to justify selection of businesses to be audited.

Conduct audits of taxpayers accounting records to determine accuracy completeness and compliance with the Citys sales and use tax ordinance and fee agreement. Crews will visit neighborhoods and perform thorough sweeping to remove debris from the streets and gutters. Sales Tax Rate The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670.

The minimum combined 2022 sales tax rate for Loveland Colorado is. The Loveland Colorado sales tax is 655 consisting of 290 Colorado state sales tax and 365 Loveland local sales taxesThe local sales tax consists of a 065 county sales tax and a 300 city sales tax. In 2020 Loveland was the only Colorado City to win the Governors Award for Downtown Excellence is the top residential recycling City in the state for 4.

The City of Loveland will begin citywide street sweeping operations Monday May 2. SALES TAX DIVISION PO BOX 0845 - LOVELAND CO 80539-0845 CITY OF LOVELAND 970 962-2708 FAX 970 962-2927 SALES TAX RETURN EMAIL.

Loveland Wants Colorado To Settle Netflix Sales Tax Issue Loveland Reporter Herald

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Sales Tax Guide Department Of Revenue Taxation

Wednesday Wisdom Real Estate Buyer Tip Realestate Unitedstates Florida Buyers Tip Real Estate Quotes Real Estate Infographic Real Estate Marketing Quotes

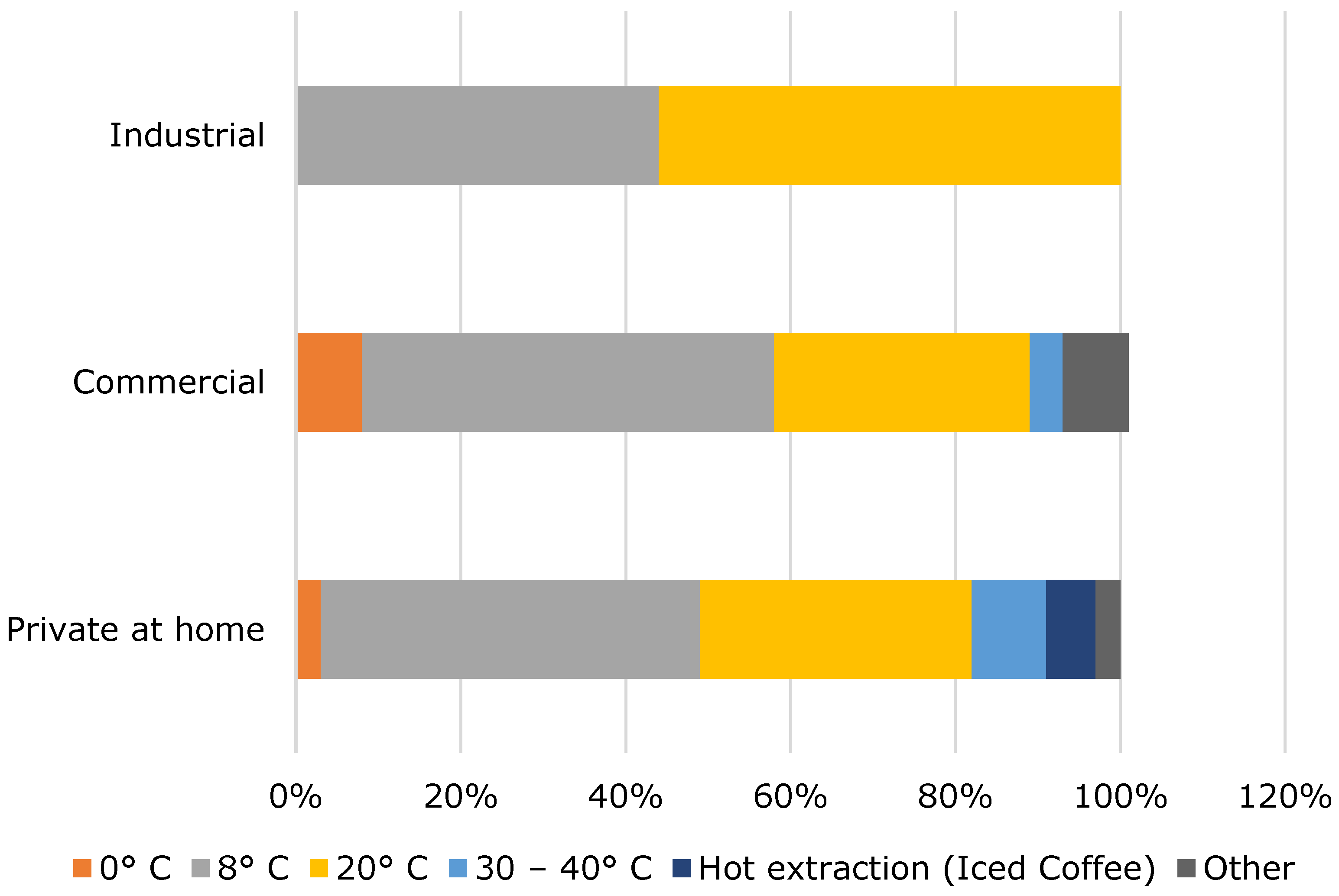

Foods Free Full Text Cold Brew Coffee Pilot Studies On Definition Extraction Consumer Preference Chemical Characterization And Microbiological Hazards Html

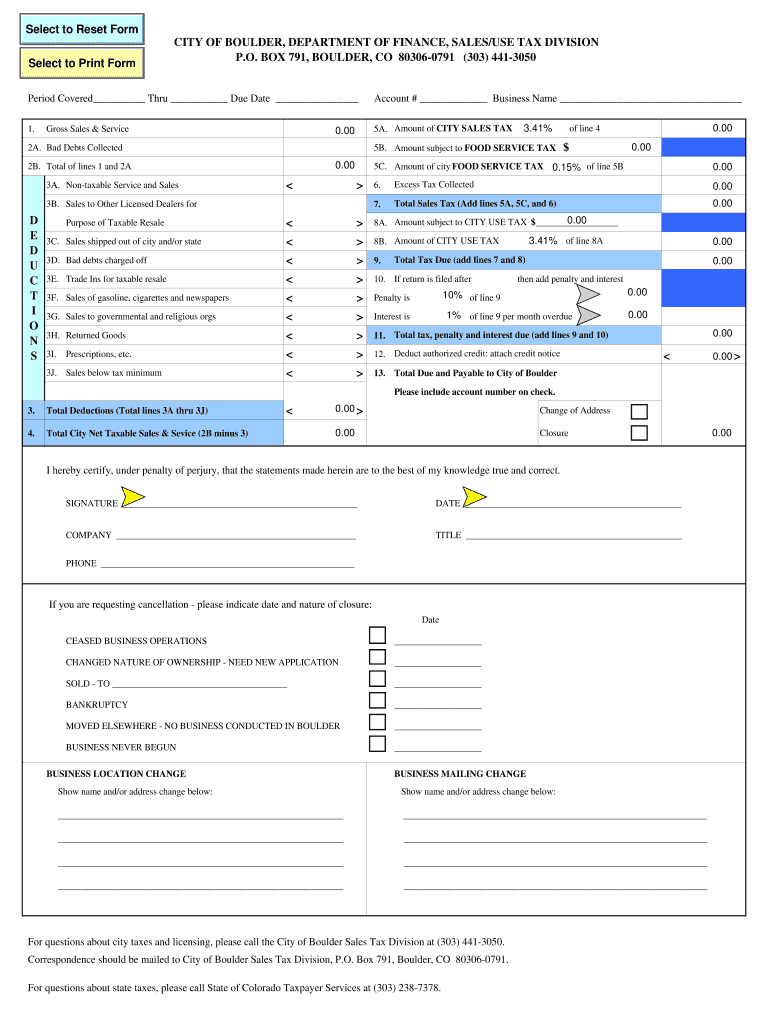

Sales Tax Boulder Form Fill Out And Sign Printable Pdf Template Signnow

Special Event Sales Tax Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

My Account Portal City Of Loveland

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation